Unlock the Secrets of Ethical Hacking!

Ready to dive into the world of offensive security? This course gives you the Black Hat hacker’s perspective, teaching you attack techniques to defend against malicious activity. Learn to hack Android and Windows systems, create undetectable malware and ransomware, and even master spoofing techniques. Start your first hack in just one hour!

Enroll now and gain industry-standard knowledge: Enroll Now!

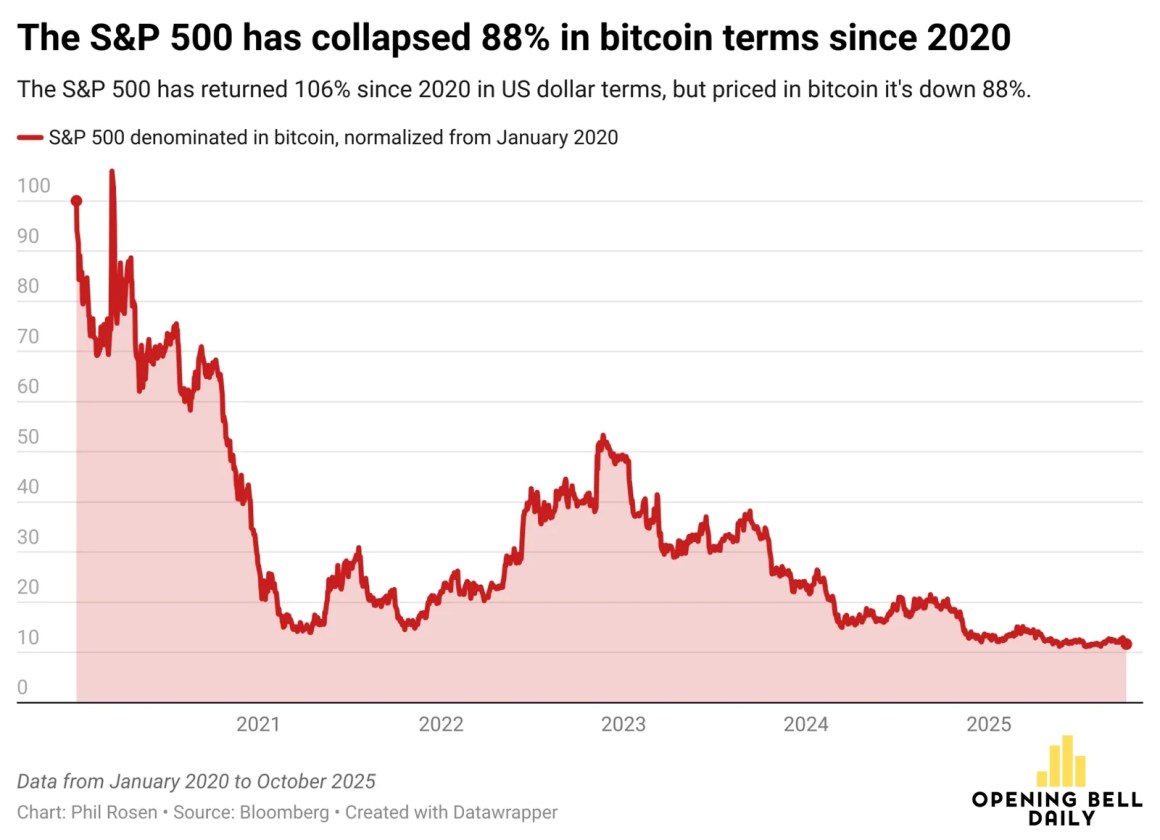

While billionaire hedge fund manager Warren Buffett has long touted investing in the S&P 500, recent data shows that since 2020, the index has underperformed Bitcoin by around 88%.

In an Oct. 5 X post by Phil Rosen, the co-founder of stock market data newsletter Opening Bell Daily, noticed that while the S&P 500 has surged 106% in USD value since 2020, it has “collapsed” significantly in BTC denomination, prompting cheers from Bitcoin pundits.

The Standard and Poor’s 500, or S&P 500, is a stock market index tracking the performance of 500 leading companies listed on stock exchanges in the United States.

Since 1957, the index has delivered an annual inflation-adjusted return of around 6.68%, which is usually higher than the average US inflation rate.

It may be why famous US entrepreneur Warren Buffett has frequently touted the S&P 500 index as the best option for the average investor, and reportedly supports a 90/10 investment strategy — with 90% of a portfolio in the S&P 500, and 10% in short-term US Treasury bonds.

S&P 500 breaks records, but so does Bitcoin

The S&P 500 has continued to break new records in 2025 and is currently at $6,715.79, having risen 14.43% since the start of the year.

Bitcoin, on the other hand, is up 32% on the year after hitting $125,000 for the first time ever on Saturday.

Put another way, according to OfficialData.Org, the return from investing $100 in the S&P 500 from the beginning of 2020 would turn into around $209.85 by July 2025. The same $100 investment in Bitcoin would be worth $1,473.87.

Related: Bitcoin corrects from $125K all-time high: Where will BTC price bottom?

Differences between Bitcoin and the S&P 500

However, comparing the two investments isn’t exactly fair.

The S&P 500 is a comprehensive benchmark for the US stock market, representing the performance of the 500 largest publicly traded companies in the country, an index that is constantly updating, and is seen as a lower risk and reward investment.

Bitcoin, on the other hand, is a singular digital asset with a completely different set of narratives — centered around scarcity, decentralization and deflation — that has exploded in adoption as investors look for new ways to increase or retain value.

Bitcoin is also relatively new, sees more day-to-day volatility and has a significantly smaller market cap than the S&P 500, at $2.47 trillion compared to a whopping $56.7 trillion.

Magazine: Bitcoin may move ‘very quick’ to $150K, altseason doubts: Hodler’s Digest, Sept. 28 – Oct. 4

Unlock the Secrets of Ethical Hacking!

Ready to dive into the world of offensive security? This course gives you the Black Hat hacker’s perspective, teaching you attack techniques to defend against malicious activity. Learn to hack Android and Windows systems, create undetectable malware and ransomware, and even master spoofing techniques. Start your first hack in just one hour!

Enroll now and gain industry-standard knowledge: Enroll Now!

0 Comments