Unlock the Secrets of Ethical Hacking!

Ready to dive into the world of offensive security? This course gives you the Black Hat hacker’s perspective, teaching you attack techniques to defend against malicious activity. Learn to hack Android and Windows systems, create undetectable malware and ransomware, and even master spoofing techniques. Start your first hack in just one hour!

Enroll now and gain industry-standard knowledge: Enroll Now!

The Bank of Korea, South Korea’s central bank, is still lukewarm on proposals to launch a won stablecoin, despite a recent meeting with the USD Coin (USDC) issuer Circle.

The South Korean media outlet Newsway reported that unnamed Circle executives have held recent meetings with officials from the Bank of Korea and lawmakers from the National Assembly.

The parties reportedly “exchanged opinions” on stablecoins in private meetings. The media outlet’s sources said they were not at liberty to reveal “the main agenda or topics discussed” at the talks.

Bank of Korea: Stablecoin Skepticism

The outlet added that Circle executives are also set to meet senior figures from the Financial Services Commission (FSC). The latter is the nation’s top financial regulator.

With a new government now developing its own financial policies in South Korea following June 3’s election, active discussions on stablecoins are now underway, with “global companies paying close attention.”

President Lee Jae-myung has pledged to launch a KRW-pegged coin for use in business and international trade.

But as USDT and USDC trading booms on South Korean exchanges, some appear to believe that Seoul should let financial institutions use USD-pegged coins in settlements.

On June 10, the Democratic Party lawmaker and key Lee ally Min Byung-deok unveiled an amended version of his private member’s bill, dubbed the Basic Digital Asset Act.

The revamped bill has several clauses pertaining to stablecoin adoption. The National Assembly held a public briefing session on the legislation on June 17.

Governor Issues Warning

An unnamed domestic crypto industry executive told Newsway:

“Global crypto companies are closely watching events in South Korea. Circle seems to be establishing contacts with the National Assembly and financial regulators because it wants to participate in the domestic market.”

The source opined that KRW stablecoin issuance was “still a long way off,” adding: “We are still at the opinion-exchanging stage.”

But the Kukmin Ilbo reported that the Bank of Korea Governor Lee Chang-yong still appears skeptical about Lee Jae-myung’s government’s stablecoin plans.

The BOK chief said that he “does not oppose” the issuance of a “won stablecoin.” However, the governor expressed concern that such a coin could actually increase demand for dollar-pegged stablecoins.

The governor explained:

“I think won-pegged stablecoins are necessary, and I am not against their issuance. [But] if won stablecoins are issued, it will be easier to exchange them for dollar stablecoins. And that will increase the demand for dollar stablecoins. In turn, that will make it difficult [for us] to manage foreign exchange operations.”

Lee Chang-yong also opined that stablecoin adoption could also hurt commercial bank profitability. He concluded:

“Once the Ministry of Strategy and Finance, the Financial Services Commission, and other relevant ministries have [reached a consensus], we plan to fine-tune policies by holding inter-ministerial consultations.”

USDT Volumes Climb

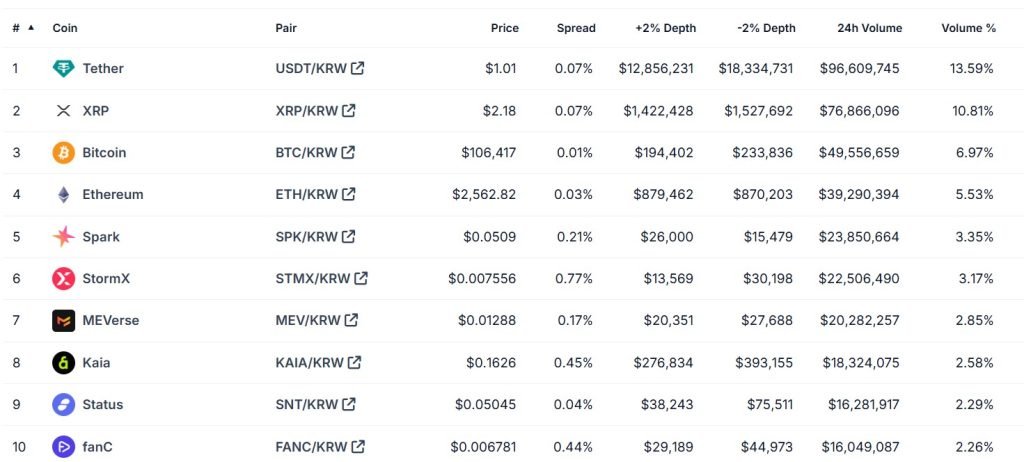

USDT trading volumes continue to soar on South Korean crypto exchange platforms. On June 18, Tether’s 24-hour volume stood at $96,609,745, representing almost 14% of all the trades conducted on the platform.

The figure is almost double the 24-hour volume of Bitcoin (BTC) ($49,556,659). So-called kimchi coins with stablecoin-related project arms – including StormX, fanC, and MEV – are also experiencing continued growth.

The post Bank of Korea Still Skeptical About Won Stablecoin Issuance Despite Circle Meeting appeared first on Cryptonews.

Unlock the Secrets of Ethical Hacking!

Ready to dive into the world of offensive security? This course gives you the Black Hat hacker’s perspective, teaching you attack techniques to defend against malicious activity. Learn to hack Android and Windows systems, create undetectable malware and ransomware, and even master spoofing techniques. Start your first hack in just one hour!

Enroll now and gain industry-standard knowledge: Enroll Now!

0 Comments