Unlock the Secrets of Ethical Hacking!

Ready to dive into the world of offensive security? This course gives you the Black Hat hacker’s perspective, teaching you attack techniques to defend against malicious activity. Learn to hack Android and Windows systems, create undetectable malware and ransomware, and even master spoofing techniques. Start your first hack in just one hour!

Enroll now and gain industry-standard knowledge: Enroll Now!

Bitcoin has hit yet another milestone as its network hashrate reached a new all-time high of 1.046 zettahashes per second, marking the strongest security level in the cryptocurrency’s 16-year history.

This hash rate breakthrough occurs at a time when approximately 93.3% of Bitcoin’s total 21 million supply has already been mined. Due to the halving mechanism that reduces mining rewards every four years, only 1.4 million BTC will remain to be created over the next century.

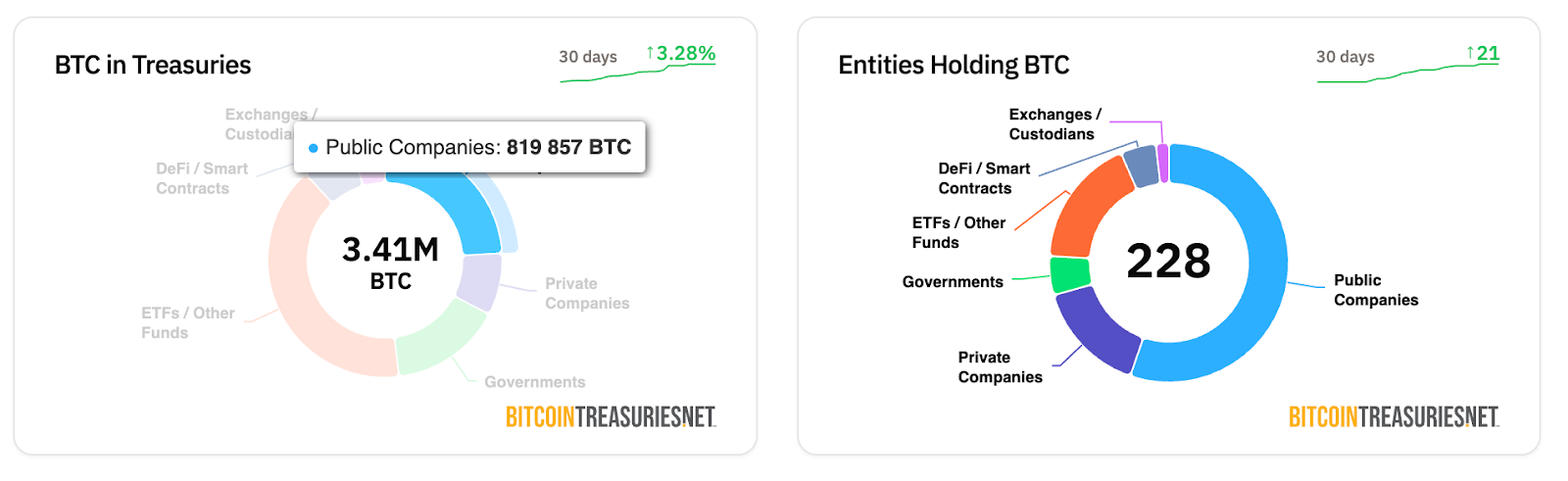

The timing proves especially relevant as 126 public companies now hold Bitcoin in their corporate treasuries, controlling 819,857 BTC, representing 3.9% of the total supply.

Meanwhile, mining difficulty has surged 6.81% to an all-time high of 121.51 trillion, creating an increasingly competitive environment where miners are liquidating massive amounts of their holdings to survive the post-halving revenue crunch.

Corporate adoption has also accelerated dramatically, with companies like Mercurity Fintech raising $800 million for Bitcoin treasury reserves.

Mining Economics Under Pressure Despite Network Strength

The mathematical precision of Bitcoin’s supply curve creates a unique scarcity dynamic that intensifies with each passing halving event, as the April 2024 halving reduced block rewards from 6.25 to 3.125 BTC, forcing miners to compete for diminishing rewards while hash rate paradoxically continues climbing.

This “engineered scarcity” becomes even more pronounced when considering that between 3.0 million and 3.8 million BTC, roughly 14% to 18% of the total supply, is permanently lost due to forgotten passwords, destroyed hard drives, and dormant addresses, including Satoshi Nakamoto’s wallet, which contains over 1.1 million BTC.

The combination of capped supply, permanent losses, and exponentially decreasing issuance creates what analysts describe as “hardening scarcity,” where Bitcoin’s adequate circulating supply may be closer to 16–17 million rather than 21 million, while traditional assets like gold remain fully recoverable and reusable.

March 2025 witnessed a devastating 50% decline in miner revenue compared to the previous year, falling to approximately $1.2 billion as the hash price plummeted to just $44.20 per petahash per second, down more than 11% since early March.

This revenue compression forced a dramatic behavioral shift among mining companies, with 15 public mining firms liquidating over 40% of their freshly minted Bitcoin in March alone.

Despite this selling pressure, Bitcoin’s network demonstrated strong resilience.

It is worth mentioning that this phenomenon occurs because of Bitcoin’s self-correcting mechanism, where mining difficulty adjusts every 2,016 blocks to maintain 10-minute block times regardless of network participation. This ensures continued operation even as inefficient miners exit the network.

Technical Analysis Points to Bullish Momentum Despite Short-Term Volatility

A careful look at the technical indicators across multiple timeframes suggests Bitcoin is positioned for continued upward momentum despite current consolidation around $106,927.

The three-year hash rate correlation chart shows a compelling relationship between network security and price appreciation, with both metrics experiencing synchronized recovery from the crypto winter lows of $20,000 and 200–300 billion hashes per second to current levels exceeding $106,000 and 890 billion hashes per second.

The exponential hash rate growth through 2024 and into 2025 coincides with Bitcoin’s push toward six-figure valuations, creating a virtuous cycle in which increased computational power secures the network and bolsters investor confidence.

Short-term technical analysis reveals Bitcoin consolidating within a constructive range, with key resistance levels at $108,026, $110,321, and $111,870, while the 25-period exponential moving average at $107,935 provides dynamic support.

The volume profile analysis shows strong accumulation zones with the heaviest trading occurring around $105,000-$107,000, establishing this as a strong value area.

The profitability indicator, showing 60.92%, also suggests that the most recent buyers remain in profit, typically preceding either continuation moves or healthy consolidation phases.

The descending trendline acting as dynamic resistance appears to be breaking down, a development that historically signals bullish momentum.

Combined with Fibonacci extension levels and golden cross formations, where shorter moving averages cross above longer ones, the technical structure initially supports projections toward $111,870.

Successful breaks potentially open paths toward $115,000-$120,000 in the near term, provided Bitcoin maintains support above the key $105,000-$107,000 value area.

The post Bitcoin Hashrate Breaks a New All-Time High – Is a Massive $BTC Price Rally Next? appeared first on Cryptonews.

Unlock the Secrets of Ethical Hacking!

Ready to dive into the world of offensive security? This course gives you the Black Hat hacker’s perspective, teaching you attack techniques to defend against malicious activity. Learn to hack Android and Windows systems, create undetectable malware and ransomware, and even master spoofing techniques. Start your first hack in just one hour!

Enroll now and gain industry-standard knowledge: Enroll Now!

0 Comments