Unlock the Secrets of Ethical Hacking!

Ready to dive into the world of offensive security? This course gives you the Black Hat hacker’s perspective, teaching you attack techniques to defend against malicious activity. Learn to hack Android and Windows systems, create undetectable malware and ransomware, and even master spoofing techniques. Start your first hack in just one hour!

Enroll now and gain industry-standard knowledge: Enroll Now!

$BONK has tumbled 14.5% amid market-wide pressure, yet a major deflationary event looms as adoption milestones approach.

With key partnerships expanding real-world utility and Grayscale adding $BONK to its institutional watchlist, the current pullback contrasts sharply with the project’s accelerating ecosystem growth. Analysts suggest the price dip may represent a consolidation phase before the next push.

How Bonk’s Burning Strategy Is Reshaping Solana’s Future

$BONK leverages the blockchain’s hybrid Proof-of-History (PoH) and Proof-of-Stake (PoS) consensus, allowing fast, scalable, and cost-effective transactions. These core attributes empower Bonk’s expansion across DeFi and NFT use cases.

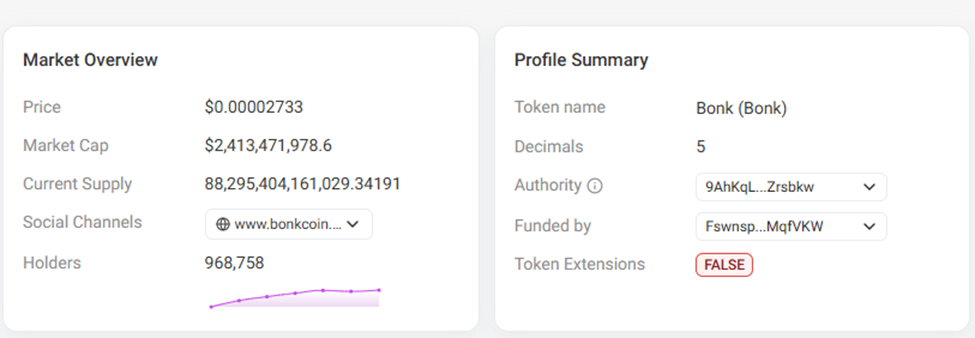

One of the most anticipated events on Bonk’s roadmap is the burning of a massive 1 trillion $BONK tokens once the project hits 1 million on-chain holders.

Right now, they’re at 968,758, just shy of the finish line. At the current pace, this event could be triggered before the end of the week.

This follows the recent removal of 500 billion tokens ($13.63 million) from circulation through fee revenue generated by the LetsBonk.fun platform. The launchpad has emerged as a strong revenue driver, surpassing competitor Pump.fun in both token launches and fee generation with a 215% monthly increase in July.

Institutional interest appears to be growing despite recent price volatility.

Further solidifying its growing credibility, Grayscale’s decision to include $BONK in its Q3 2025 institutional watchlist is a game-changer.

Bonk’s rise isn’t confined to trading charts. A partnership with Dabba Network lets people in underserved communities buy internet hotspots using $BONK, plus a portion of that gets burned in the process. This is a win for both adoption and deflation.

Another major collaboration is with DeFi Development Corp., launching the Bonk Community Validator that promises to enhance Solana’s decentralization and potentially attract even more institutional interest.

BONK’s real-world utility continues to grow. From Magic Eden and Jupiter to Orca and Solana NFT projects, it’s being used as a reward mechanism, a payment tool, and a community driver.

The recent acquisition of Exchange Art shows Bonk’s serious ambitions in the NFT realm, moving it beyond meme coin status.

In Solana’s fast-and-loose degen culture, that’s no small feat. For now, $BONK is the meme coin in the driver’s seat.

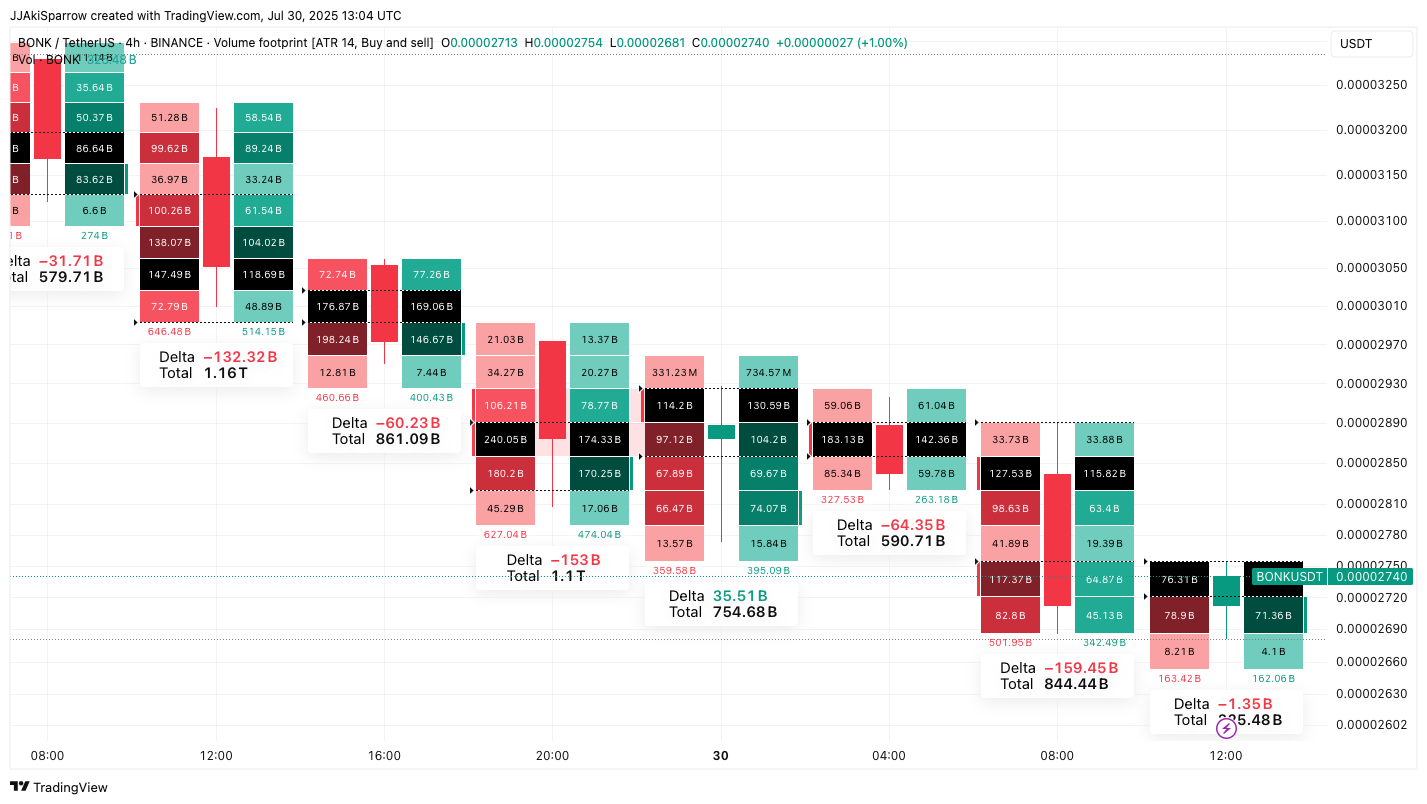

$BONK/USDT Breakdown Deepens as Distribution Zone Collapses

$BONK/USDT has transitioned from a euphoric momentum rally into an accelerating correction, marked by the collapse beneath a key structural level around $0.00003000. Last week’s price action already hinted at exhaustion, as $BONK began carving out a broad, rounded top.

The structure suggested a shift from trend acceleration into distribution, which is a classic topping pattern where volatility compresses but underlying sell pressure quietly builds. The visual breakdown is sharp.

After multiple rejections near $0.00003800, the rounded top resolved into a clear breakdown once the $0.00003000 support failed.

This breach triggered a steep selloff with increasing volume and increasingly one-sided order flow.

The volume profile underneath the distribution zone was already rising steadily. Coupled with this, the candles following the breakdown show expanded red bars, confirming that sellers are now acting aggressively and with conviction.

For instance, one standout data point is the -132.32B delta recorded on July 29, paired with over 1.16T in total volume. This means that aggressive sellers overwhelmed buyers by a large margin, breaching the bid in size.

Another session posted a staggering -153B delta on similar volume, demonstrating persistent sell-side dominance. These are huge margins tipping dominance to the sellers.

Even recent attempts to stabilize have been weak—a +35.51B delta on 754.68B volume was dwarfed by the magnitude of prior selling pressure. Momentum remains net negative, and buyers appear unwilling to contest deeper lows.

This move fits squarely into the macro structure $BONK built throughout July.

The early-month rally was driven by sharp trend acceleration—clean vertical impulses supported by rising volume.

But once the price plateaued near the highs and began carving rounded, overlapping candles, the transition was underway. The final sign was the support break, and now, the price has entered a breakdown phase with increasing speed.

Unless the market reclaims the $0.00002950–$0.00003000 range decisively with volumes, $BONK remains vulnerable to further decline.

The post $BONK Sinks 14% – Grayscale Watchlist and 1 Trillion Token Burn Hint at Imminent Rebound appeared first on Cryptonews.

Unlock the Secrets of Ethical Hacking!

Ready to dive into the world of offensive security? This course gives you the Black Hat hacker’s perspective, teaching you attack techniques to defend against malicious activity. Learn to hack Android and Windows systems, create undetectable malware and ransomware, and even master spoofing techniques. Start your first hack in just one hour!

Enroll now and gain industry-standard knowledge: Enroll Now!

(@DabbaNetwork)

(@DabbaNetwork)

0 Comments