Unlock the Secrets of Ethical Hacking!

Ready to dive into the world of offensive security? This course gives you the Black Hat hacker’s perspective, teaching you attack techniques to defend against malicious activity. Learn to hack Android and Windows systems, create undetectable malware and ransomware, and even master spoofing techniques. Start your first hack in just one hour!

Enroll now and gain industry-standard knowledge: Enroll Now!

Coinbase Institutional has issued a bullish forecast for the crypto market in the second half of 2025, predicting new all-time highs for Bitcoin while warning about emerging systemic risks from the explosive growth in corporate Bitcoin adoption.

The exchange’s latest monthly outlook reveals a shift in the corporate market. According to BitcoinTreasuries, 130 public companies now hold 820,542 BTC worth approximately $88 billion, up from just 89 companies in April.

This corporate Bitcoin trend, created by new accounting rules effective in December 2024, has resulted in what Coinbase describes as an “attack of the clones” scenario, where numerous firms are emulating MicroStrategy’s early Bitcoin treasury strategy through leveraged funding mechanisms.

Corporate Bitcoin Treasury Accelerates Despite Risk Warnings

The 2024-2025 regulatory shift opened the door for corporate adoption, with research firm Bernstein projecting that corporations could collectively allocate as much as $330 billion into Bitcoin by 2029.

However, Coinbase’s Global Head of Research, David Duong, warns that the emergence of publicly traded crypto vehicles (PTCVs) focused solely on Bitcoin accumulation introduces substantial systemic risks to the broader crypto ecosystem.

As he said, these risks manifest as forced selling pressure from convertible bond maturities and motivated discretionary selling that could trigger market-wide liquidations.

Michael Saylor’s Strategy (formerly MicroStrategy) leads this charge, which has accumulated 580,955 BTC worth approximately $61.4 billion and continues its aggressive acquisition strategy with nine consecutive weeks of purchases.

The company’s success has inspired a global phenomenon, with Japanese investment firm Metaplanet announcing an ambitious $5.4 billion capital raise to accumulate 210,000 BTC by 2027, representing roughly 1% of Bitcoin’s maximum supply.

This follows its rapid ascent to become the tenth-largest corporate Bitcoin holder with 8,888 BTC.

The momentum extends across multiple jurisdictions, with UK-listed firms joining the movement. The Smarter Web Company recently acquired an additional 45.32 BTC, boosting its holdings by 55% to 168.08 BTC.

At the same time, other British companies, such as Abraxas Capital and Bluebird Mining Ventures, have announced major Bitcoin strategies.

Meanwhile, Nasdaq-listed Mercurity Fintech Holding revealed plans to raise $800 million for Bitcoin treasury reserves, potentially making it the 11th-largest corporate holder.

Regulatory Clarity and Market Dynamics Shape Optimistic Second-Half Outlook

Despite systemic risk concerns, Coinbase maintains its bullish stance for the second half of the cryptocurrency market.

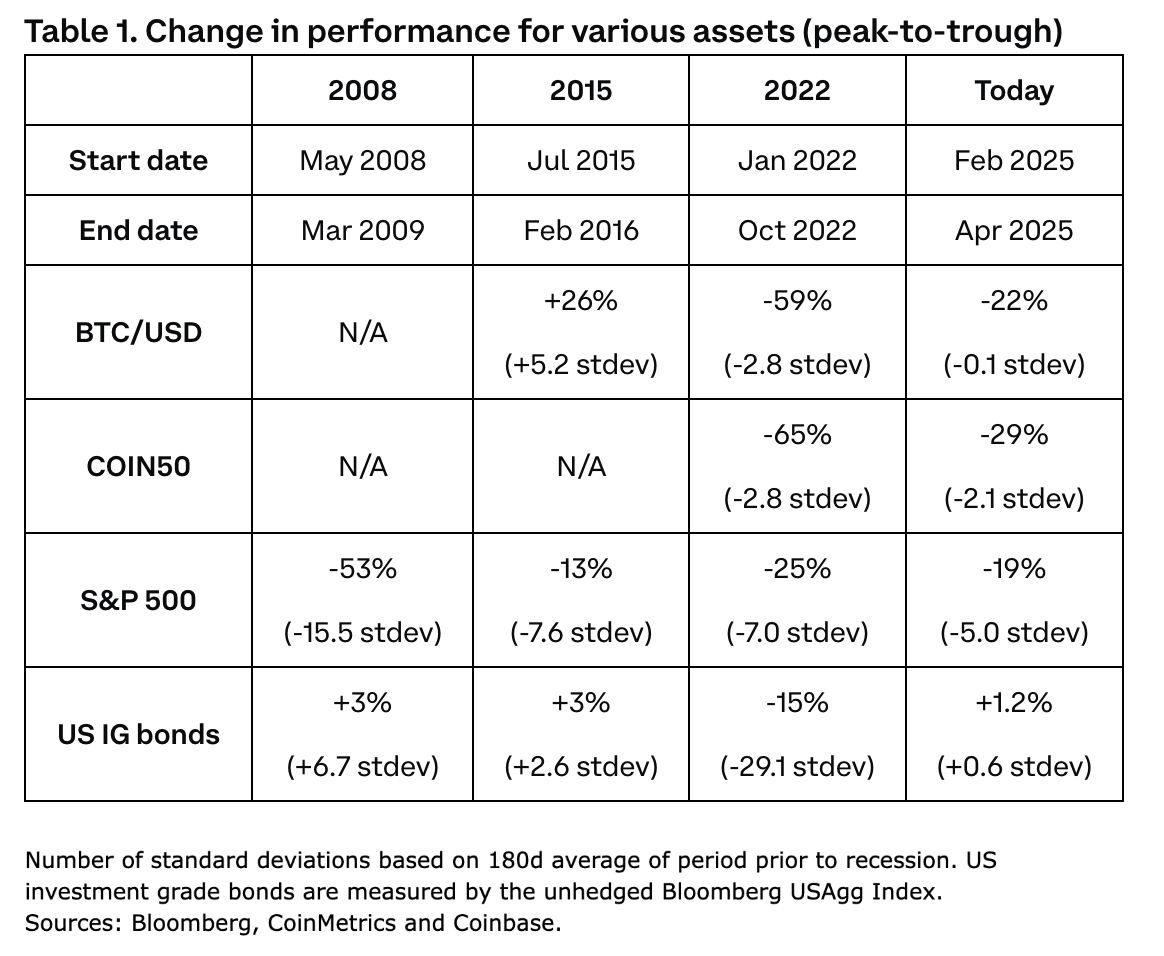

The firm’s analysis indicates that recession fears have largely dissipated following early 2025 trade disruptions, with stronger-than-expected economic data suggesting either continued expansion or mild slowdown rather than severe contraction.

This improved macro environment, combined with rising global liquidity metrics and diminishing tariff impacts, creates favorable conditions for continued Bitcoin appreciation while potentially benefiting store-of-value assets over altcoins if long-term yields rise due to deficit concerns.

The regulatory shifts represent the most transformative development. The U.S. has abandoned its previous “regulation by enforcement” approach and favors a comprehensive framework for development.

Bipartisan momentum behind stablecoin legislation appears unstoppable. The Senate could approve the GENIUS Act as early as next week, followed by a House review of complementary bills establishing reserve requirements, compliance parameters, and consumer protections.

Administration officials express confidence that unified legislation could reach President Trump’s desk before the August recess, potentially paving the way for broader crypto market structure bills like the CLARITY Act.

The SEC’s handling of approximately 80 pending crypto ETF applications adds another layer of market-moving potential. Decisions on multi-asset funds are expected as early as July 2, in-kind creation mechanisms by October, and single-name altcoin ETFs throughout the fall.

While Coinbase acknowledges that correlation with equities remains elevated, structural tailwinds, including sovereign adoption by countries like Venezuela and Russia for international trade, add to Bitcoin’s growing role as an uncorrelated store-of-value asset.

This further supports the firm’s prediction of new all-time highs in the second half of 2025.

The post Coinbase Eyes $330B Corporate Bitcoin Wave; Warns of Imminent Systemic Shock appeared first on Cryptonews.

Unlock the Secrets of Ethical Hacking!

Ready to dive into the world of offensive security? This course gives you the Black Hat hacker’s perspective, teaching you attack techniques to defend against malicious activity. Learn to hack Android and Windows systems, create undetectable malware and ransomware, and even master spoofing techniques. Start your first hack in just one hour!

Enroll now and gain industry-standard knowledge: Enroll Now!

UK-listed tech company

UK-listed tech company  The U.S. Senate Set for Historic Stablecoin Showdown as GENIUS Act nears final vote.

The U.S. Senate Set for Historic Stablecoin Showdown as GENIUS Act nears final vote.

0 Comments